Regulatory compliance management for banking and financial institutions: The data and analytics way

1. Regulatory Compliance in Banking

In the financial services industry, the pendulum continues to swing further in the direction of lower risk and higher regulation. In light of increased customer interactions online, the regulations placed on financial institutions become all the more important. Regulating authorities all over the world are moving towards stringent reporting and data collection requirements to ensure the safety of customer data and capital. The time and cost of regulatory compliance and reporting are rising due to expanding regulations. Technology usage in data collection and analysis has resulted in enhanced supervisory models that display improved risk assessment. Compared to pre-financial crisis spending levels, operating costs spent on compliance have increased by over 60 percent for retail and corporate banks2.

According to the Competitive Enterprise Institute, the average cost to maintain compliance can total up to $10,000 per employee as reported by large firms1.

Types of Regulatory Compliance in Banking

Advancing supervisory and regulatory approaches requires a better understanding of regulations that are in force, and the major ones are listed here.

Increased regulation has indeed played a big role in the increasing demand for financial and risk data, and reporting requirements are data-heavy. Financial institutions have to manage, clean, and analyze data to reduce exposure to risk and gain insights through analytics.

2. Challenges of banking regulatory compliance

Compliance problems are fundamentally data problems. Regulatory compliance analytics is a difficult task because of the magnitude, complexity, and constant change that define data in financial service. Due to the lack of a centralized data warehouse for reporting activity and the inability of legacy technology to do it at scale, what might be a straightforward reporting exercise often devolves into an operational nightmare.

Consider the numerous main categories of data, including reference data, transactional data, operational data, and security data. Each varies greatly in terms of size, form, and frequency of change, and is handled by various teams. Additionally, banks and other financial institutions can be required to conduct fresh analyses and reporting on particular subsets or supersets of this data with each new compliance requirement.

The rise of regulations all over the world places strain on the limited resources that financial institutions have. Inadequate frequency of risk assessment weakens compliance integration in business processes and can prevent organizations from seizing new opportunities.

Increasing domestic and international compliance standards

Standards for data, such as GDPR, HIPAA, PIPEDA, CCPA, FACTA, and others can sometimes be used across geographical boundaries. Compliance fatigue can be real, with more time and money spent on understanding and following legislation. The compliance standards about employee data confidentiality need a relook too, with trends like Bring-Your-Own-Device (BYOD) being commonplace.

Legacy and siloed data

Complex big data environments increase vulnerabilities and backdoors, and successful implementation of cloud services — hybrid or multi-cloud environments need skilled talent. Out-of-the-box security solutions will not always be able to address all the permutations, and adopting a bespoke privacy solution from a service provider with experience can be worth the investment. To have data management under control, having a relook at the infrastructure that stores data is also crucial.

Data security

Organizations should ensure robust oversight processes on customer data from the moment it is acquired, when it is processed, and what procedures are followed. This can be challenging, as the data gets fragmented while passing through organizational silos.

In 2020, organizations spent US $3.86 million on average on data breaches, according to a survey by IBM3.

Customer trust, especially in the financial sector, can have much severe implications. With remote work going mainstream and organizations increasingly adopting hybrid working scenarios, people tend to use digital tools for their banking needs and the cost of a data breach can be significantly high

3. Overcoming banking compliance challenges with data analytics strategy

Real-time monitoring and automated data analytics can mitigate risks for financial institutions, but come at a high cost of employee time. Executives with a clear understanding of multiple regulations are typically higher up the ladder, and it would be a waste of their time to have them check for discrepancies. Integrated data governance platforms can ensure compliance requirements are met, and provide a platform to manage both risk and compliance.

a. Embrace a data first modernization approach

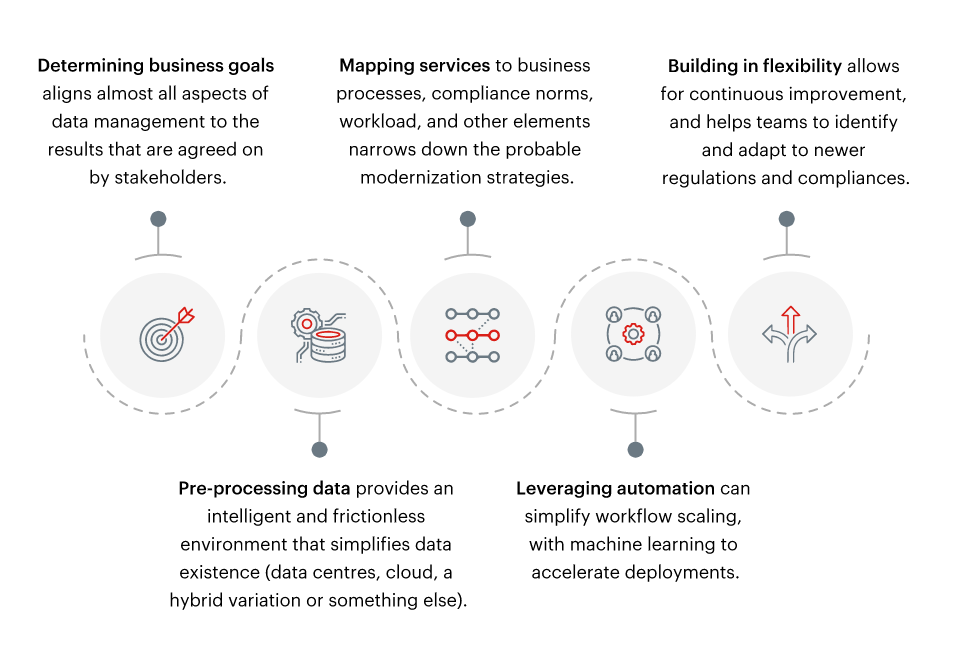

In a data-first modernization approach, organizations first determine the business-critical data, where it is used and how can it be utilized best. For financial institutions, developing a strategy with data as the primary focus reduces silos and legacy system errors and duplications. Infrastructure modernization that consolidates, processes, and stores data closer for analysis and decision-making adds efficiency and better insights, that can maximize productivity. The steps below are designed to deliver flexibility and agility with data modernization:

b. Streamline data management and security

An unbiased assessment of data operations is necessary for better data information, and working with experienced financial data services partners can help in untangling challenges. Legacy data solutions come with inadequacies like being slow to scale or staying connected to process large amounts of data. Creating a centralized source of data with governance mechanisms can provide financial firms the necessary leverage to meet newer norms, and be ready for changes that are in accordance with the market. They can simplify trusted entitlement processes, rigorous application of existing rules and regulations, system monitoring, and distributing data to users, applications, and other destinations safely anywhere in the world.

c. Deploy AI and analytics at scale

Real-time analysis of both qualitative and quantitative compliance risk factors is made possible by analytical algorithms. These algorithms also assist in identifying and investigating trends that may be indicative of fraud, abnormal behavior, and possible rule violations. AI-based solutions enable financial institutions to automate their data collection, improve decision speed and quality, and see to it that regulatory compliance obligations are met.

The architecture, application programming interfaces (APIs), and data pipelines serve as building blocks that can deploy models at scale.

They can also automate manual risk scoring so that financial institutions can build fault-tolerant systems that are compliant with various regulations, and ensure faster, secure transactions. Another important area where machine learning solutions help in risk mitigation and compliance with regulatory requirements is Know-your-customer (KYC) Analysis. But to build such AI/ML models at scale and deploy them across the organizations, financial institutions should acquire the services of the right talent and skills. Leaders should work on removing silos and identify use cases across the enterprise, in different contexts. These use cases prioritize the analytics, based on the expected impact on customer experience. By following standardized, repeatable processes, these models establish a space for experimentation and rapid prototyping.

d. Use NLP to monitor regulatory change management

A Thomson Reuters survey revealed that compliance professionals from 800 financial services firms worldwide receive regulatory updates at an average rate of more than 200 per day4. Keeping track of such frequent updates and changes, understanding what needs to be done, so that any penalties or risks are not levied — is not just tedious but stress-inducing too. Financial institutes can analyze and classify documentation, extract relevant information through AI/ML/natural language processing, and streamline how regulatory compliance is managed. These AI solutions can also help in monitoring protocols adherence so that there are no gaps.

4. Case Study

Top-3 investment bank improves trade surveillance and regulatory compliance with optimized data performance and faster reporting

Situation

- The client wanted to revamp their data infrastructure and adhere to MAR, MiFID II and other regulatory compliances by means of effective alerting and reporting capabilities.

- Meeting the compliance standards meant that there had to be robust data pipelines in place for analysis and availability of data that was mapped to global statistics and other internal data aggregators in real-time.

What Sigmoid did?

- Used Spark-based ETL to deliver improvements in the data pipeline in terms of performance and resource optimization, significantly reducing timelines.

- Developed a workflow and interface for alerting that provided detailed information and feedback about the various alerts.

- Created platform for ad-hoc surveillance and pipeline for locate wash trades.

- Integrated alerting and monitoring, and improved overall orchestration.

- Created new data flow models, infrastructure maps, data retention policies, privacy constraints and regulatory frameworks.

Results

Faster system response time

Reduction in generation of false alert

rows of data processed daily

Sigmoid’s data engineering and AI services empower financial institutions to stay compliant and mitigate risks faster. We help organizations by modernizing their data infrastructure that enables faster access to quality data. Our scalable data models help flag malpractices, improve the quality of decisions, and implement stronger governance policies.

5. Conclusion

The huge volumes of data that financial institution possess, can reveal untapped opportunities - but outdated and siloed solutions worsen existing issues, especially with compliance. Being reactive about this can lead institutions to adopt pricey solutions in a hurry, and that can cut the razor-thin profit margins too. Understanding the needs of the organization and discussing them with relevant teams can be beneficial in shortlisting important features that are necessary. This can be a great starting point in creating a bespoke solution that incorporates technology into the risk and compliance management processes, improving security by reducing the chances of human error, and detecting potential cases of fraud. They can help financial institutions tighten up their trading activities, surveillance and monitoring across markets and continents with ease, by effectively processing large volumes of data and effectively using the same to flag, report and investigate irregularities in compliance.

FAQs

Regulatory compliance in banking refers to the adherence to laws, regulations, and industry standards designed to maintain the integrity and stability of financial systems. It encompasses a wide array of rules covering areas such as data privacy, risk management, anti-money laundering (AML), Know Your Customer (KYC), Basel III, General Data Protection Regulation (GDPR), Customer Due Diligence (CDD), counter financing of terrorism (CFT) and more.

Sigmoid's expertise lies in leveraging advanced data analytics to effectively help financial institutions interpret, manage, and comply with these multifaceted regulations.

Banks are subject to various compliance regulations, including Anti-Money Laundering (AML), Know Your Customer (KYC), Basel III, General Data Protection Regulation (GDPR), and more. AML regulations focus on detecting and preventing money laundering activities, KYC ensures customer identity verification, Basel III mandates capital and liquidity requirements, and GDPR ensures data protection and privacy.

Regulatory compliance significantly impacts banking operations by necessitating stringent data security measures, thorough reporting procedures, enhanced risk management protocols, and continuous staff training. Banks must allocate resources and implement robust systems to ensure compliance, which often affects operational processes, documentation, and resource allocation.

Data analytics is crucial in helping banks navigate and comply with regulatory requirements. Advanced analytics tools assist in monitoring and analyzing vast amounts of data, enabling banks to identify potential risks, detect anomalies, ensure accurate reporting, and proactively manage compliance-related challenges. Analytics also aids in enhancing operational efficiency and decision-making processes.

Non-compliance with regulatory standards can lead to severe consequences for banks, including hefty fines, legal penalties, reputational damage, loss of customer trust, and potential business disruptions. Moreover, regulatory bodies might impose restrictions or sanctions on non-compliant institutions, impacting their ability to operate or expand in the financial market.

Contact

Get in touch with our experts to know more about leveraging data & analytics for enhanced regulatory compliance

Check how Sigmoid's financial services helped F500 banks and financial institutions with enterprise grade automated data solutions