Empowering data analytics with a multi-cloud architecture for banks

Reading Time: 7 minutes

The impact of a powerful cloud combination

In the U.S., the Financial Industry Regulatory Authority (FINRA) advises businesses to be capable of switching cloud providers, assess the risks of vendor lock-in, and determine the suitability of multi-cloud solutions for specific business requirements. This proactive approach is driven by banks’ need to improve operational efficiency, adapt to rapid market changes, uphold stringent compliance standards, and enhance customer experience. Amidst these complexities, the adoption of a multi-cloud data infrastructure has emerged as a beacon of hope for the banking sector. By leveraging a multi-cloud strategy, banks can position themselves for a future characterized by resilience and adaptability. A recent study by IDC predicts that by 2025, 25% of tier 1 banks worldwide will deploy their data warehouses and analytics operations in the cloud.

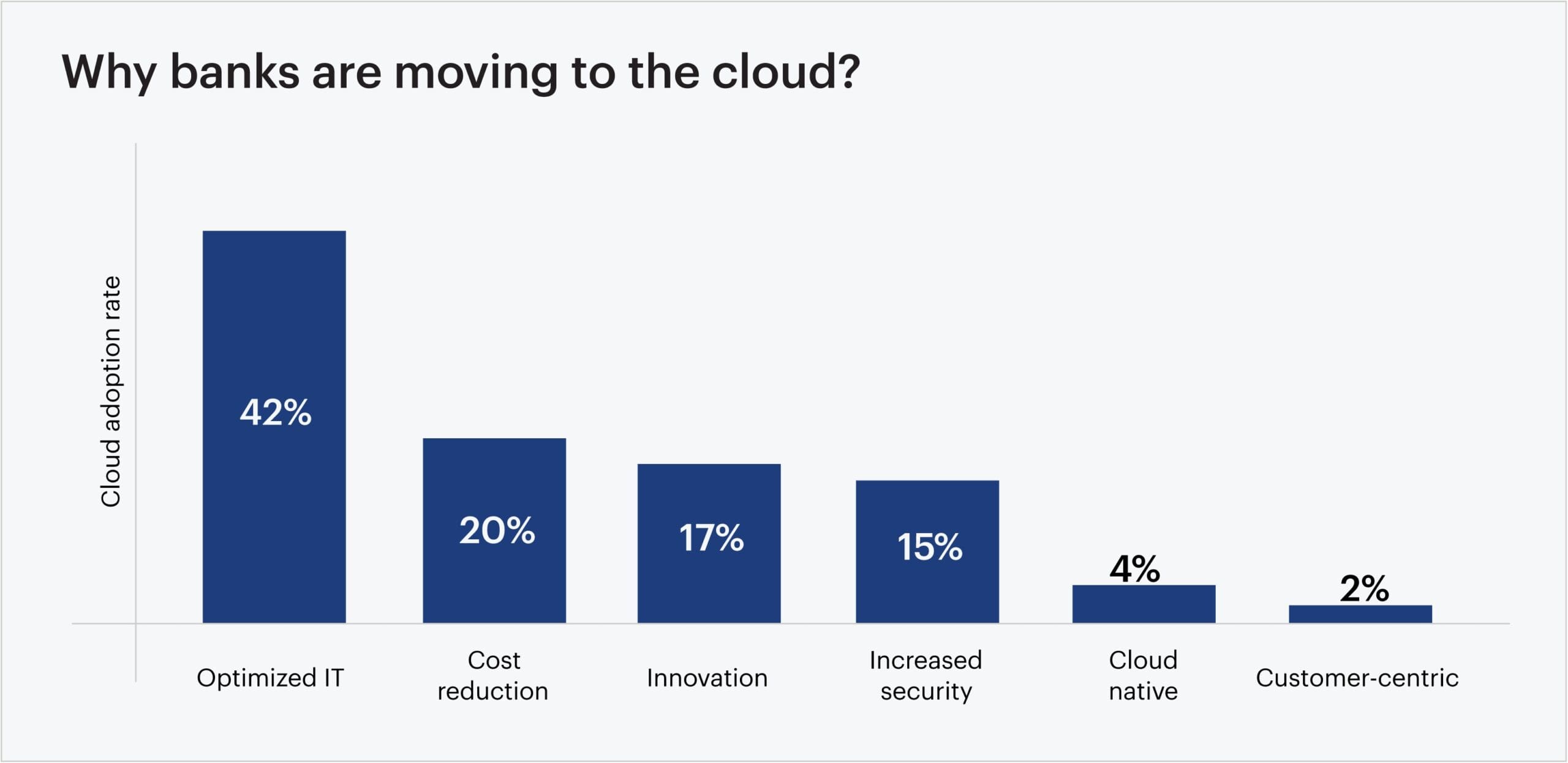

Source: Appinventiv

Data infrastructure has become the bedrock upon which every strategic decision rests. It enables banks to gain real-time insights into customer behavior, manage risk precisely, and comply rigorously with regulatory demands. Today, a bank’s data infrastructure, scalability, and security are no longer mere advantages but prerequisites for maintaining a competitive edge.

The 2023 S&P Global multi-cloud survey reveals that 97% of organizations employ multiple cloud providers, primarily driven by cost optimization, data residency, and enhanced business agility.

What traditional cloud challenges can multi-cloud models overcome?

Multi-cloud strategy is a game-changing approach to data infrastructure that redefines how banks operate.

This approach empowers banks to leverage the unique capabilities of different cloud providers while mitigating risks associated with vendor lock-in and ensuring high availability. A well-executed multi-cloud strategy offers banks a strategic advantage, enhancing their agility, resilience, and ability to innovate. By seamlessly integrating multiple cloud providers into their bank’s data infrastructure can optimize costs and improve performance.

A multi-cloud strategy can address several data and technology challenges faced by banks.

| Challenge | Solution |

|---|---|

| Redundancy and availability | A multi-cloud approach minimizes the risk of downtime and data loss by spreading infrastructure and applications across multiple cloud providers and regions. Redundancy, load balancing, and failover mechanisms ensure that banking services remain highly available even in the face of unforeseen disruptions, ultimately enhancing customer trust and satisfaction. |

| Vendor lock-in mitigation | Banks can reduce dependence on any single vendor and gain substantial negotiation leverage during contract renewals. By embracing interoperability standards and open-source technologies, they ensure seamless transitions between different cloud environments, maintaining control over their technology stack and infrastructure choices. This flexibility empowers banks to optimize costs and minimize the risk of service disruptions |

| Disaster recovery and business continuity | Replicating data and applications across diverse cloud environments provides robust disaster recovery options. For instance, a bank might replicate its core banking system on AWS and its customer relationship management (CRM) on Azure. In case of a data center failure affecting one provider, the other can seamlessly take over, ensuring uninterrupted operations. |

| Application portability | Using containerization technologies like Docker and Kubernetes for application development ensures a consistent run across different cloud environments. By encapsulating applications and their dependencies within containers, they ensure consistent deployment and execution across various cloud environments, promoting flexibility and agility. |

Each major cloud provider brings their unique strengths to the table in facilitating data and analytics solutions. Selecting the right combination of services from the right providers can be the cornerstone of building a highly effective multi-cloud data infrastructure.

Benefits of a multi-cloud strategy

By strategically blending the strengths of different cloud platforms banks can achieve superior performance, cost-efficiency, and resilience. This approach ensures that every facet of the organization benefits from the unique capabilities offered by diverse cloud providers.

- Risk mitigation with multi-cloud

- Optimizing workloads with different clouds

- Interoperability and data federation

- Tailoring cloud choices to regional preferences

With cyber threats and data breaches on the rise, relying on a single cloud provider can be risky. A multi-cloud architecture provides built-in risk mitigation capabilities by distributing data and services across multiple platforms. In doing so, it helps banks safeguard against potential outages or vulnerabilities associated with a single cloud provider. Additionally, they can take advantage of each provider’s security features, ensuring robust data protection and regulatory compliance.

If a bank experiences downtime with one cloud provider, it can seamlessly switch to another provider’s resources to maintain critical operations. This redundancy minimizes the impact of service disruptions, ensuring continuous access to financial services for customers.

Banks can choose the most suitable cloud provider for each workload, considering factors such as performance, cost, and scalability. A bank can leverage Google Cloud Platform (GCP) for marketing analytics due to its powerful data processing capabilities and machine learning tools. Meanwhile, they can use AWS for core banking services, taking advantage of its extensive network infrastructure and compliance certifications.

Multi-cloud architecture allows banks to seamlessly exchange data across different cloud platforms for data sharing and collaboration while avoiding vendor lock-in. For instance, banks can use multi-cloud data federation to enhance their customer insights. They can federate data between AWS, GCP, and Azure to access the unique analytics capabilities of each platform, resulting in more comprehensive customer profiles and personalized services.

Banks often operate in diverse regions, each with its cloud preferences. A multi-cloud approach allows them to tailor cloud choices to regional preferences, ensuring that local teams can work with the platforms they are most comfortable with.

A multinational bank operating in a country with stringent data privacy and compliance regulations can choose the most prevalent service provider in that location. It will help the bank meet local requirements and gain the trust of regional customers. Meanwhile, the bank can continue to utilize other service providers in different regions, ensuring a seamless and region-specific approach to cloud services while maintaining centralized control over their global operations.

Understanding multi-cloud approaches for banking

By strategically distributing workloads and data across diverse cloud environments, banks can mitigate risks, optimize costs, and stay agile. Various scenarios emerge in a multi-cloud strategy, each with its unique benefits and considerations. In this section, we explore the diverse tactics for optimizing cloud resources and enhancing organizational capabilities:

| Multi-cloud strategy | Strengths | Concerns | Use cases |

|---|---|---|---|

| Decentralized cloud adoption | Flexibility: Maximum flexibility in deploying workloads across cloud providers. Fast deployment: Quick adoption of cloud services. Vendor agnostic: Avoids vendor lock-in and allows for experimenting with multiple platforms |

Poor governance: Lack of governance can lead to security risk. Limited optimization: Workloads might not be optimized for the specific cloud provider |

Initial multi-cloud exploration: Suitable for exploring multi-cloud and understanding its benefits and challenges. Short-term solutions: For short-term projects or initiatives where quick deployment is a priority. |

| Structured multi-cloud allocation | Optimized workload placement: Segmenting workloads based on specific factors like data security, workload type, and vendor preferences. Cost control: Allocate workloads to cloud providers offering the best cost-efficiency. |

Vendor affinity: There is a risk of slipping from segmentation back into arbitrariness due to vendor preferences Operational complexity: Workloads across different clouds can introduce complexity in terms of monitoring and governance. Potential data silos: Segmenting workloads can lead to data silos, making it harder to leverage data for organization-wide insights. |

Data security and compliance: Useful when strict data security and compliance requirements demand isolation and separation of specific workloads. Multi-product deployment: Ideal for deploying various types of applications such as traditional compute workloads and collaboration software, across multiple clouds. |

| Tailored cloud provisioning | Reduced vendor lock-in: Mnimizes vendor lock-in by allowing deployment across multiple cloud providers. Use of proprietary services: Projects can leverage proprietary cloud services while still having control and governance in place. |

Complex governance: Managing multiple cloud providers and diverse workloads can lead to governance challenges. Integration challenges: Integrating and maintaining applications across different cloud platforms can be resource-intensive. |

Enterprise-wide IT support: Large enterprises with multiple business units that require IT support for distinct needs. Hybrid IT environments: Ideal for organizations that want to use a mix of cloud services while maintaining central governance. |

| Parallel cloud deployment | High availability: Simultaneously deploy applications across multiple clouds to ensure high availability and reduce downtime. Redundancy: Create redundancy to protect against cloud provider outages by spreading workloads. Flexibility: Provides flexibility in choosing cloud-specific functions and open-source components. |

Cost: Multiple branches for cloud-specific components can increase operational costs Data synchronization: Data consistency across different cloud providers can be challenging and may require additional efforts. |

Critical applications: Organizations such as financial services with mission-critical applications that require the highest level of uptime and availability. Disaster recovery: Useful for businesses that want to ensure robust disaster recovery plans by deploying across multiple clouds. |

| Portable multi-cloud approach | Resource optimization: Optimize resource utilization by running normal operations in one cloud and bursting traffic into another as needed. Automation: High levels of automation and abstraction allow for seamless workload shifting and deployment. |

Complexity and cost: High levels of automation and abstraction can introduce complexity and increase operational costs. | Resource scaling: Useful when there’s a need to scale resources rapidly in response to varying workloads. Automation-driven environments: Ideal for highly automated environments where manual intervention is minimized to ensure seamless workload portability. |

Conclusion

The adoption of a multi-cloud strategy has ushered in a new era of possibilities for banks seeking to future-proof their data infrastructure. With agility, efficiency, security, and compliance at the forefront of banking operations, a well-executed multi-cloud approach has become the key to unlocking these advantages. As we have explored throughout this blog, the significance of making informed decisions about service providers cannot be overstated. Each major cloud provider brings its unique strengths to the table, and selecting the right combination of services is the cornerstone of building a highly effective multi-cloud data infrastructure.

About the Author

Gunasekaran S is the Director of Data Engineering at Sigmoid and with over 20 years of experience in consulting, system integration, and big data technologies. As an advisor to customers on data strategy, he helps in the design and implementation of modern data platforms for enterprises in the Retail, CPG, BFSI, and Travel domains to drive them towards becoming a data-centric organization.

Featured blogs

Subscribe to get latest insights

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI

Featured blogs

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI